December 04, 2023

Life value

STELLAPHARM was born to care and protect patient’s health, to help enhancing their lives and living longer. Your health, for today and for future.

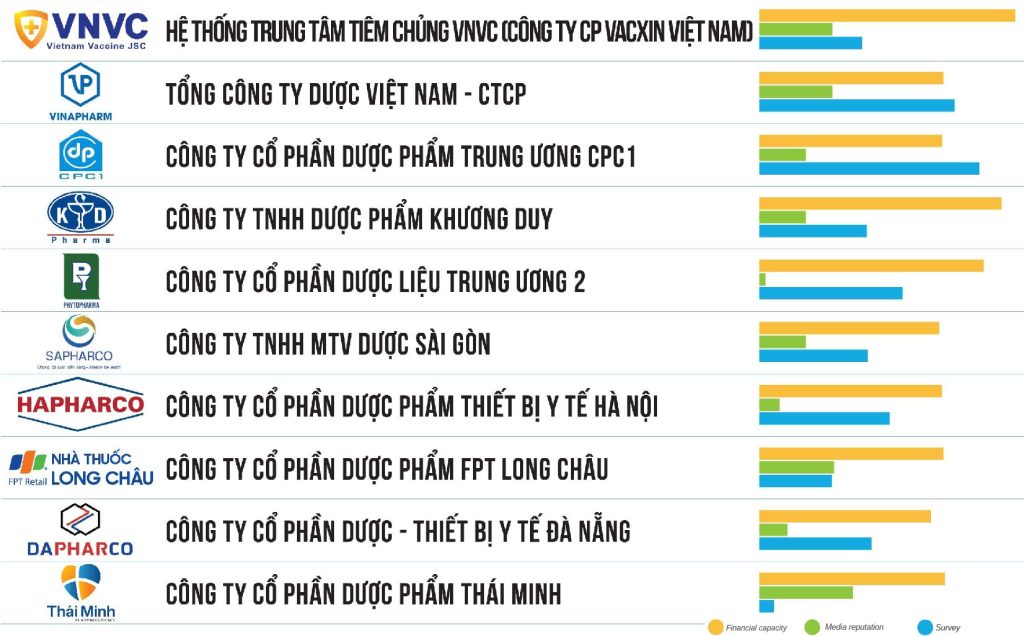

On November 28, 2023, Vietnam Evaluation Report Joint Stock Company (Vietnam Report) officially announced the Top 10 prestigious Pharmaceutical Companies in 2023.

Top 10 reputable Pharmaceutical Companies are built on scientific and objective principles. Companies are evaluated and ranked based on 3 main criteria: (1) Financial capacity shown on the most recent year’s financial statements; (2) Media reputation is assessed using the Media Coding method – coding articles about the company on influential media channels; (3) Survey of relevant subjects will be conducted in October – November 2023.

“Resistance” of the pharmaceutical industry in the context of slow economic growth

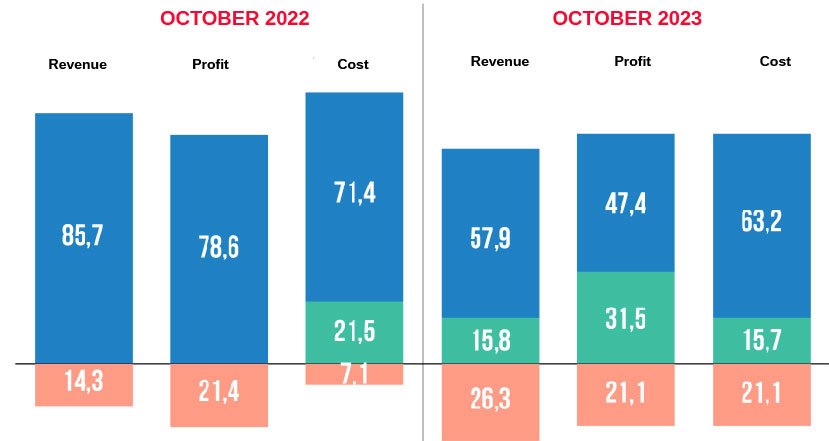

Looking back at the journey from the beginning of the year until now, after recording prosperous business results in the first 6 months, low demand on a large scale has caused the growth momentum of the pharmaceutical industry to decelerate in the third quarter and witness profits. differentiation between businesses. Compared to Vietnam Report’s survey results a year ago, the proportion of pharmaceutical enterprises with revenue growth decreased, while in the opposite direction, 26.3% of enterprises in the industry recorded revenue. worse than the same period (+12.0% compared to 2022). However, overall in the first 10 months of 2023, positive colors still play a leading role in the business results of businesses in the industry, with the majority of pharmaceutical businesses stabilizing and maintaining revenue growth. (73.7% of businesses) and profits (78.9% of businesses). In general, with its position as an essential industry, less affected by market “shakes” and economic decline, in the gloomy context of most fields from the beginning of the year until now, the industry Although pharmaceuticals are not completely “immune”, they are still a bright spot in the overall picture.

Up to now, after the first 10 months of 2023, the general situation of the drug distribution channel in hospitals (ETC – prescription drugs) has witnessed quite good growth. In particular, the major contribution to the growth of this channel comes from the fact that drug bidding regulations in hospitals have been loosened and become more open. Typically, the Law on Medical Examination and Treatment 15/2023/QH15 creates conditions for public hospitals to have autonomy in capital to invest in facilities to suit medical examination needs and overcome congestion at the hospital. Hospitals, patients have to wait because medical facilities lack machinery and equipment. Thanks to that, the flow of patients coming for medical examination and treatment at the hospital increased, promoting drug consumption on the ETC channel. In addition, the extension of drug registration numbers (Resolution 80/2023/QH15) takes effect from January 2023, Circular No. 06/2023/TTBYT regulates drug bidding at public health facilities. Establishing and removing difficulties related to drug bidding and drug prices effective from April 27 or Decree No. 07 and Resolution No. 30 issued in March of the Government have partly resolved the difficulties. Immediate difficulties for hospitals and pharmaceutical manufacturing enterprises, especially the organization of procurement and extension of drug circulation certificates, help make ETC drug bidding activities more exciting in the last months of the second quarter, with a volume of Supplies show signs of improvement and are relatively complete at hospitals, and more foreign drugs are imported than before.

Meanwhile, the business situation in the OTC (over-the-counter medicine) segment shows signs of going sideways, even slightly declining and is in the “mixed yellow and brass” phase – according to the majority of pharmaceutical industry experts. shared with Vietnam Report. First of all, purchasing power through the OTC channel is somewhat affected by weaker demand as consumer income decreases. Growth has maintained in the first quarter, with a downward trend from the second quarter and an upward trend in the second half of the year. also encountered many challenges. In addition, after a long period of epidemic, taking advantage of market chaos during the period of sudden increase in demand for use and hoarding of health care products, respiratory products, Health care products have exploded while quality control remains difficult. Counterfeit and counterfeit products have appeared, causing confusion for consumers and negatively affecting healthy development. of the pharmaceutical market.

Reviewing the difficulties from the beginning of the year until now, the top 5 biggest difficulties according to pharmaceutical businesses’ assessments include: (1) Slow economic growth; (2) Weak consumer demand; (3) Fluctuations in energy and input material prices; (4) Competition between businesses in the same industry; and (5) Pressure from rising exchange rates. In 2023, fluctuations in energy prices, input materials, risks from the supply chain, and increased logistics costs are no longer the hottest issues like last year and give way to the slow growth story of Vietnam. economy, but still in the top 5 named challenges. In fact, the Vietnamese pharmaceutical market still lacks stability, because production materials depend up to 90% on imports from abroad. This dependence makes the pharmaceutical industry sensitive to external factors such as exchange rate fluctuations, import prices or shocks in supply. In addition, most businesses focus on producing popular drugs on the market, while specialized drugs that require modern preparation techniques have not received the same attention. worthy. Domestic pharmaceutical companies currently mainly focus on producing generic drugs with low value, low price, and poor competitiveness, leading to a situation where they have to compete with imported generic drugs and compete with imported generic drugs. internal industry competition. Therefore, there exists a situation of overlapping production and competition for market segments.

Source: Vietnam Report

About STELLAPHARM

Stellapharm is one of leading generics pharmaceutical companies and strong producer of anti-viral drugs in Vietnam. The company established in Vietnam in 2000; and focuses on both prescription drugs and non-prescription especially in cardiovascular diseases, antiviral drugs, anti-diabetics drugs, etc. and our products are now used by millions of patients in more than 50 countries worldwide.

The company is globally recognized for its quality through our facilities have been audited and approved by stringent authority like EMA, PMDA, Taiwan GMP, local WHO and others.

Additional information for this article: Stellapharm J.V. Co., Ltd. – Branch 1

A: 40 Tu Do Avenue, Vietnam – Singapore Industrial Park, An Phu Ward, Thuan An City, Binh Duong Province, Vietnam

T: +84 274 376 7470 | F: +84 274 376 7469 | E: info@stellapharm.com | W: www.stellapharm.com

Continuing the program of the 32nd session, on the afternoon of April 16, the National Assembly Standing Committee gave opinions on the Law Project amending and supplementing a number of articles of the Pharmacy Law. Reporting at the meeting, Minister of Health Dao Hong Lan said that compared to the current law, the draft Law

The version grants pharmaceutical business licenses to non-profit pharmaceutical entities that engage in commercial activities to ensure essential medicines reach a wider range of the population. HÀ NỘI — A revised version of the Law on Pharmaceuticals 2016 will be presented to the National Assembly for discussion and feedback during a legislative meeting from